Quantifying the Financial Impact of Code Red Conditions for Shippers

Jan 6, 2021

Now that 2020 is in the rear view mirror, shippers are being challenged with quantifying how CODE RED conditions in the transportation marketplace are impacting them.

In our recent CODE RED Webcasts our resources addressed critical issues that can help shippers plan for a future that is fraught with high uncertainty and concerns that freight costs could go through the roof in 2021.

And that is why the one question we’ve been repeatedly asked is: How can we quantify the financial impact that CODE RED conditions will have on our freight budgets? This is not a theoretical question and answering it requires an understanding of conditions in the transportation marketplace, and more importantly, an understanding of your company’s transportation and logistics footprint.

With respect to conditions in the marketplace, there are truly significant issues. For example, the Shanghai Containerized Freight Index highlights just how much ocean rates have escalated for all shippers. In 2019, it cost about $1000 - $1400 to move a container in the Trans-Pacific Lanes. In December 2020, shippers were paying between $3,000 - $4,000 per container.

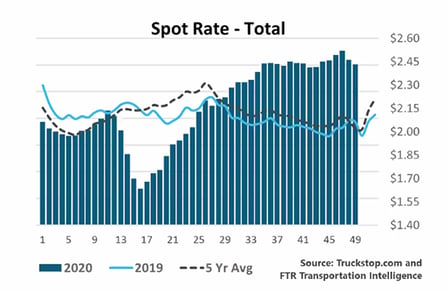

The truckload market also saw significant increases in 2020. According to Truckstop.com or DAT’s Trendlines, in early January 2020, spot rates were running a bit under $2.00 per mile. In December, spot rates shot up to $2.50. That’s a sizeable increase.

The parcel market didn’t hold back either. UPS and FedEx announced their usual 4.9% rate increase for 2021, but also layered new surcharges for shippers with large volumes and other increases in accessorial fees, making it a challenge for shippers to quantify their total parcel cost increase. If you’re looking for help in this area, tools like our Parcel Toolbox can help you account for these changes.

Looking ahead, it will be interesting to see how the year will play out. As we learned from the experts in our CODE RED Webcasts, demand will remain tight for at least the first two quarters based on inventory replenishment issues, economic growth and possible weather delays. In our most recent CODE RED Webcast, ocean expert, Peter Tirschwell, Vice President at IHS Markit, addressed the congestion issues at the West Coast Ports:

“Normally this time of year […] the ports are generally quiet. That’s the opposite of the situation right now. The ports are overloaded, they’re seeing growth rates versus prior years in November and December that are largely in excess of last year. It’s to the point where we’re going into a situation right now that’s actually quite worrisome. Conditions are not improving, they’re deteriorating, and very well might deteriorate even further.”

Whether things get better in the near term future has yet to be determined. And that is why the second step in answering the financial impact of CODE RED conditions is to understand your company’s transportation and logistics footprint. While there are significant benefits to having great data for planning and negotiations, one of the things that shippers frequently overlook is the significance of being able to define that footprint. And that is why TranzAct’s Rapid Assessment Process can be an invaluable tool in helping to quantify the financial impact of CODE RED conditions.

We’d welcome the opportunity to share some valuable insights that will help you navigate in these CODE RED conditions. In the meantime, have a wonderful 2021.